At MPPL Financial, we specialize in helping successful individuals and families make informed financial decisions aligned with what matters most to them. For over 40 years clients have trusted us to build, protect, and preserve their wealth—allowing them to live life with confidence.

Our sophisticated wealth management team provides unbiased guidance and deep expertise, helping you navigate complex financial decisions with confidence and maximize life’s most pivotal moments.

Our seamless integration of every aspect of your financial life allows us to develop a comprehensive financial plan, expertly tailored to align with a tax-smart, institutional-quality investment strategy.

Our client relationships are built on proactive care, attentive responsiveness, and a commitment to making a meaningful impact in your life.

Life’s just better when you partner with a wealth manager who understands you.

While every MPPL Financial client has a unique financial journey, they all share one common thread—trust in our guidance. Our clients value our ability to empower them with knowledge and confidence, helping them make informed decisions that secure their ideal lifestyle and turn long-term financial goals into reality.

Balancing demanding careers, family responsibilities, and financial goals can be challenging. That’s why wealth builders turn to us—to help establish a strong financial foundation for a prosperous future while still enjoying the lifestyle they desire today.

How We Help:

A new set of critical decisions arises for those who have accumulated wealth, especially when approaching retirement or planning their legacy.

We help clients dream big and plan wisely so they can:

Whether managing day-to-day operations or preparing for a future transition, every strategic business decision impacts an owner’s entire financial picture.

How We Help:

Complex compensation packages are a key component of a corporate executive’s wealth, but navigating them effectively requires specialized knowledge and strategic planning.

Our advanced financial planning provides the expertise and strategies needed to maximize these benefits and build lasting wealth.

Whether you’re part of a hospital system or own a private practice, navigating the complexities of financial planning and investing as a high-income, highly taxed professional requires specialized knowledge from a trusted partner to maximize results.

How We Help:

Whether due to the loss of a spouse or divorce, navigating this transition can be overwhelming. We serve as a trusted, objective partner to help you gain financial clarity during this emotionally challenging time.

How We Help:

As our client, expect us to inspire you to envision new possibilities for your life and legacy—ones you may never have imagined possible.

Our holistic financial planning approach, combined with a purpose-driven investment strategy, is designed to give you the confidence to live life to the fullest while making a meaningful impact on those who matter most.

It all starts with a conversation.

As an independent fiduciary financial advisor, we follow a consistent, methodical approach that provides clients with financial clarity and confidence for life’s most meaningful moments.

Every relationship begins with a meaningful conversation about you. We take the time to truly understand your priorities, your aspirations for the life you want to live, and your complete financial picture.

With a clear understanding of your goals, values, and priorities, we gather the necessary data to create a personalized financial roadmap and a purpose-driven investment strategy—one that we continuously monitor and optimize to keep you on track.

Our deep, ongoing engagement ensures that we help you navigate financial transitions with agility—whether you’re preparing for planned life events or adapting to unexpected changes.

We meet you where you are in your financial journey, providing insights that encompass topics from the simple to the complex.

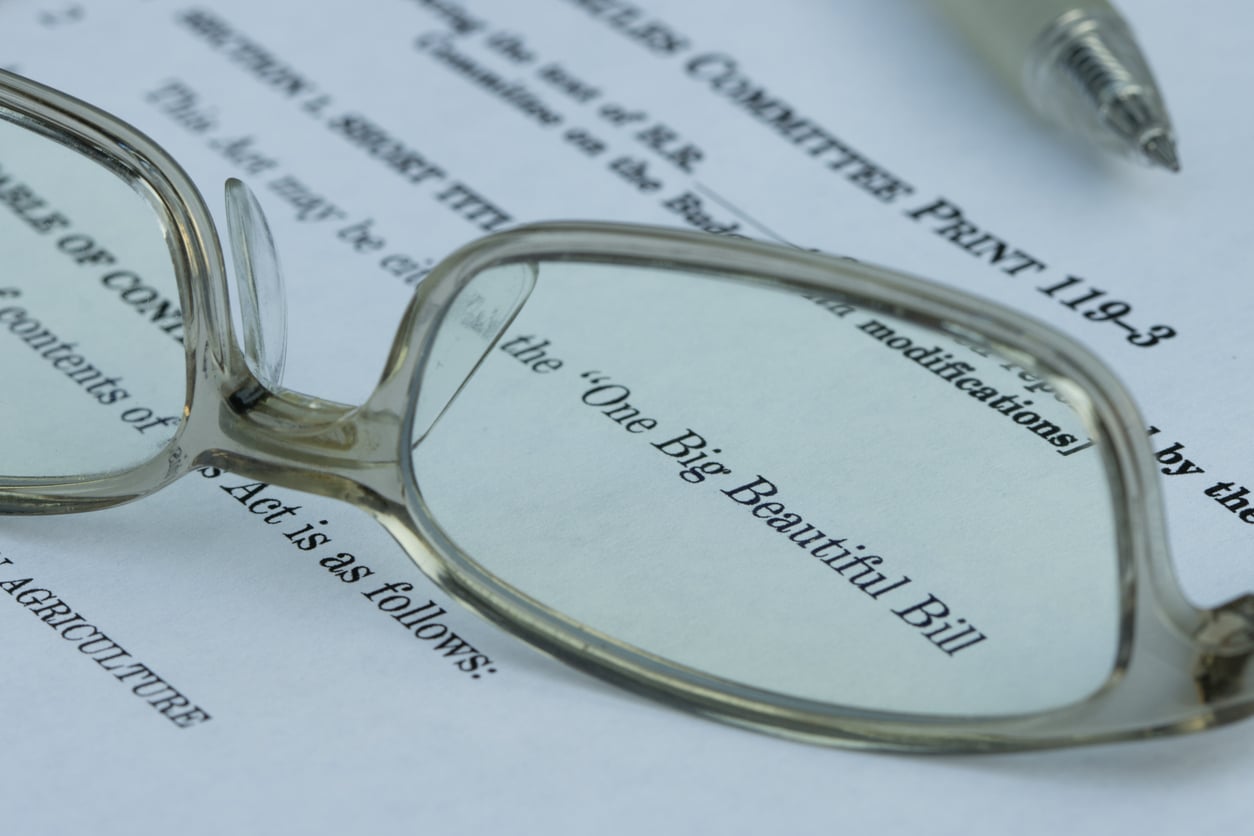

The recently passed legislation, informally known as the “One Big Beautiful Bill”, has introduced a series of sweepi...

Contrary to what many retirees may think, selecting a Medicare Part D (prescription drug) plan is not a one-time decisio...

Retirement might still be a few years away, but getting your finances in shape now can make a huge difference later. We ...

For many clients, the annual gift exclusion is an important planning opportunity. In 2026, the annual exclusion for tax-...

Many people don’t realize how much the landscape shifted with the SECURE Act of 2019 — and more recently, with follo...