Financial Planning

We inspire our clients to dream big for their life and legacy. Together, we create a comprehensive financial plan to live fully and make a lasting impact.

Financial Advice for a Lifetime

Our robust financial plans are built on a collaborative, personalized approach. They are dynamic, addressing every question—even the ones you haven’t considered.

Learning About You

From day one, we’re committed to understanding your goals, values, and priorities. Through in-depth discovery, we assess your unique situation and how it connects to every financial aspect of your life.

Analyzing Data in the Context of Your Life

We analyze how the different aspects of your wealth interact and impact your goals. Our handpicked advisory board of specialists collaborates across disciplines to strategically recommend the best options for your unique situation.

Collaborating on Your Options

We present our findings and recommendations through an interactive process that combines deep discussion and visual data analysis—exploring opportunities, addressing concerns, and solving challenges from every angle.

Empowering You With a Financial Blueprint

Your personalized MPPL Blueprint is a comprehensive financial plan that maps your path forward. Securely stored in an encrypted digital vault, it stays current by linking to your financial accounts—providing clarity as you move toward your envisioned life.

Proactive Monitoring & Updates

Your MPPL Financial Blueprint is continuously adjusted to your evolving life. We regularly review and refine it with you, ensuring you stay financially aligned with your goals while adapting to both opportunities and challenges.

Experience Our Unique Advisory Approach for Greater Results

We believe collaboration leads to better outcomes. That’s why we take a team-based approach, providing lifelong advice tailored to each client.

Every advisory board is handpicked to fit the client’s specific needs, combining our experienced advisors with specialists as necessary. These specialists come from our trusted network and include top attorneys, psychologists, CPAs, business planners, investment bankers, risk managers, and more.

Our unique advisory board model brings more perspectives, deeper insights, and smarter strategies—ultimately delivering greater results for our clients.

Financial Planning Areas

- Education

- Retirement

- Income planning

- Risk management

- Stock option and equity compensation

- Tax planning

- Wealth transfer, estate, and legacy

- Charitable planning

We also provide specialized divorce financial planning services leveraging our in-house Certified Divorce Financial Analyst, CDFA.

Wealth Builders

Affluent Individuals and Families

Add Your Heading Text Here

Add Your Heading Text Here

Add Your Heading Text Here

Add Your Heading Text Here

Add Your Heading Text Here

Add Your Heading Text Here

Perspectives To Prosper

We meet you where you are in your financial journey, providing insights that encompass topics from the simple to the complex.

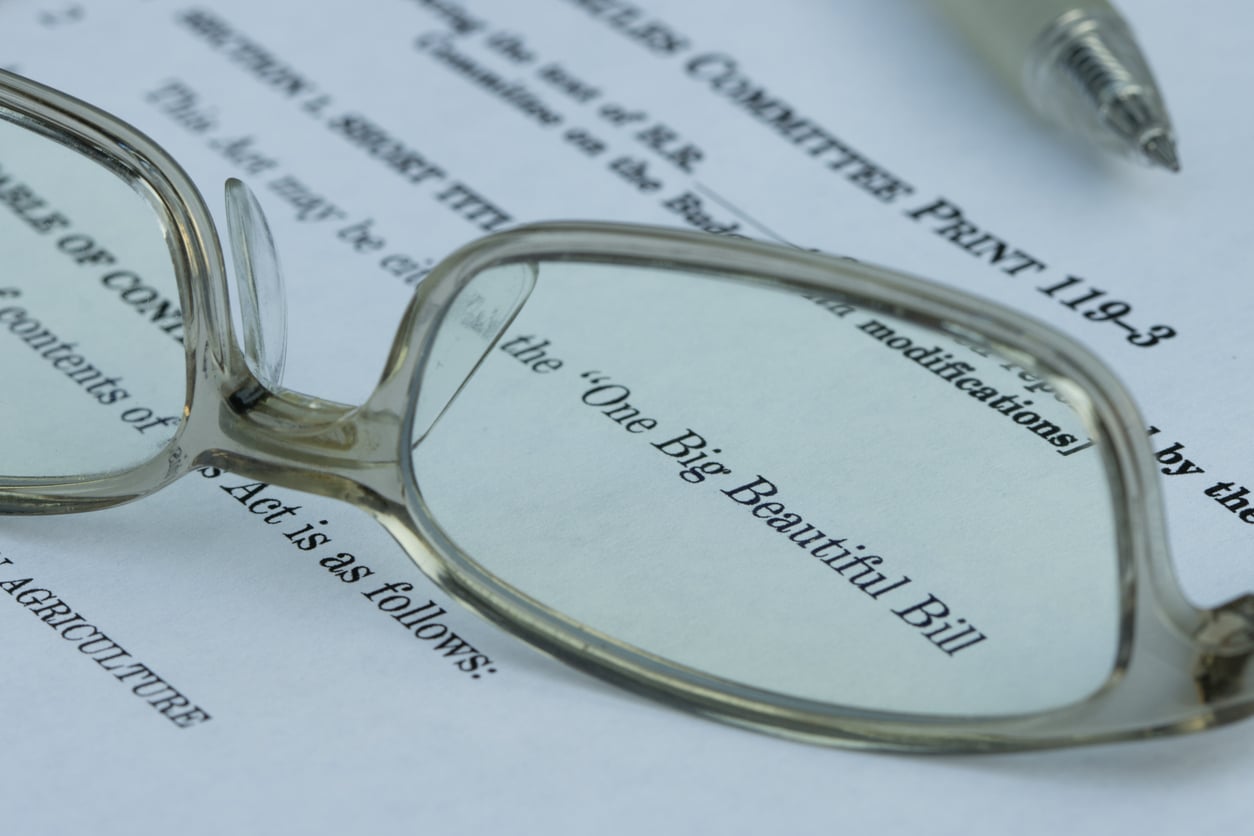

Tax-Smart Planning Opportunities Under the “One Big Beautiful Bill”

The recently passed legislation, informally known as the “One Big Beautiful Bill”, has introduced a series of sweepi...

How to Get Your Financial House in Order Before Retirement

Retirement might still be a few years away, but getting your finances in shape now can make a huge difference later. We ...

Five Things About Gifting That All Donors Need To Know

For many clients, the annual gift exclusion is an important planning opportunity. In 2026, the annual exclusion for tax-...

Why Inherited IRAs Deserve Your Attention

Many people don’t realize how much the landscape shifted with the SECURE Act of 2019 — and more recently, with follo...

The Team of Experts Business Owners Need Before Selling a Business

For many business owners, the sale of their company is the largest financial transaction of their lives, and critical to...