Understanding Medicare can be daunting. Here’s a primer of the key facts that you need to know when exploring the various options available to you.

Enrollment Dates

Initial enrollment period*

Begins 3 months before you turn 65; ends 3 months after the month you turn 65

General enrollment period

January 1 through March 31 each year

Special enrollment period

Under certain circumstances, you can enroll beyond age 65 without paying a penalty.

* If you miss your initial enrollment period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The longer you wait, the higher the penalty.

Two Options for Medicare Coverage

1. Original Medicare

A blend of coverage from the government (Part A and Part B) and private health insurers (Part D and Medigap). It includes:

Part A: Hospital insurance

Part B: Medical insurance

Part D: Prescription insurance, Medigap, and Supplemental Insurance

2. Medicare Advantage

Also called Medicare Part C, Medicare Advantage is offered through private insurance approved by Medicare. It includes hospitalization, medical, and prescription drugs.

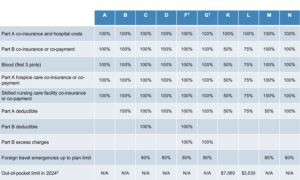

Coverage: Medicare Supplement Insurance (Medigap) Plans

Plans C and F are not available to people who are newly eligible for Medicare, as of 1/1/20.

1 Plans F and G also offer a high-deductible plan in some states.

2 Plan N pays 100% of the Part B co-insurance, except for a co-payment of up to $20 for some office visits and up to a $50 co-payment for some

emergency room visits.

3 Plans K and L have an out-of-pocket yearly limit.

Source: medicare.gov/health-drug-plans/medigap/basics/compare-plan-benefits

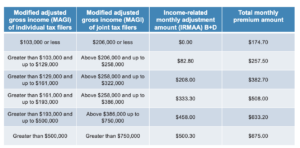

Medicare Calculations for 2024

Source: cms.gov/newsroom/fact-sheets/2024-medicare-parts-b-premiums-and-deductibles

Learn More

Visit Medicare.gov or contact your MPPL Financial Advisor for guidance on determining the best approach for your Medicare needs.

The information in this article is drawn from sources believed to be reliable. However, MPPL makes no warranties as to the accuracy of all information. Consult a qualified professional before making any decisions about your Medicare coverage.