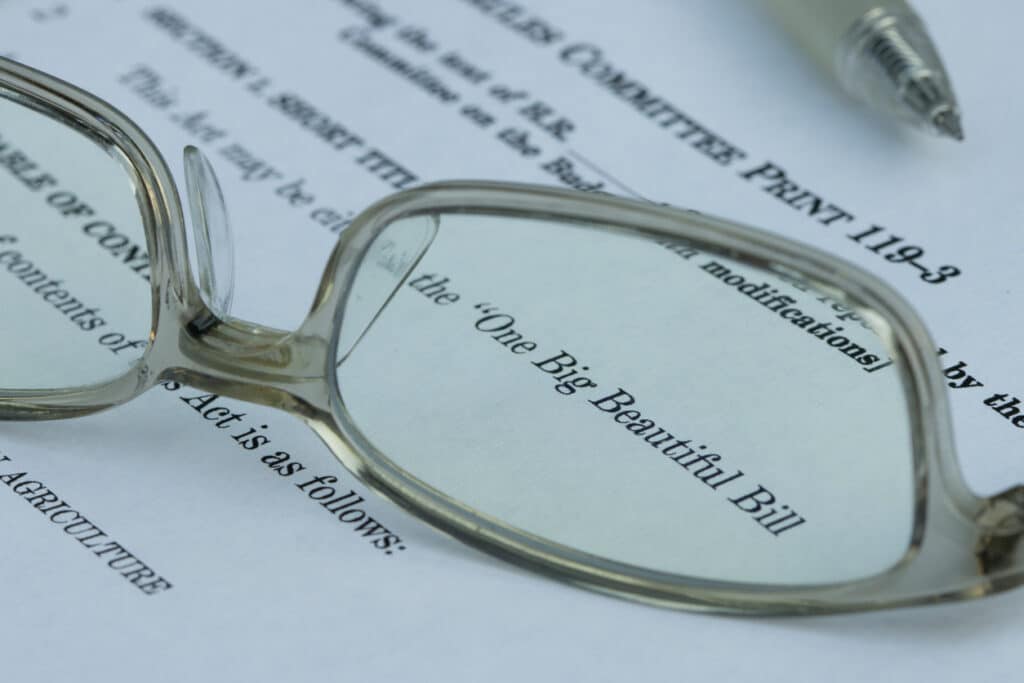

Tax-Smart Planning Opportunities Under the “One Big Beautiful Bill”

The recently passed legislation, informally known as the “One Big Beautiful Bill”, has introduced a series of sweeping tax changes, creating new planning opportunities for individuals, families, and business owners. While the headlines have focused on broader economic implications, the real story for our MPPL Financial clients lies in the short- and long-term strategies now […]

A Six-Point Medicare Part D Checklist To Get the Best Prescription Drug Coverage

Contrary to what many retirees may think, selecting a Medicare Part D (prescription drug) plan is not a one-time decision. As Terri Rau, a financial advisor who manages MPPL Financial’s Crystal Lake, IL office explained, “With the high cost of prescription drugs, it’s important for all existing Medicare enrollees to carefully review Medicare Part D […]

How to Get Your Financial House in Order Before Retirement

Retirement might still be a few years away, but getting your finances in shape now can make a huge difference later. We caught up with Dan Evans, CFP®, one of MPPL Financial’s go-to experts on retirement planning, to discuss what pre-retirees should be thinking about, and doing, well before their last day on the job. […]

Five Things About Gifting That All Donors Need To Know

For many clients, the annual gift exclusion is an important planning opportunity. In 2026, the annual exclusion for tax-exempt gifts to a single beneficiary is $19,000, which is the amount for 2025. Brian Resch, CPRS®, Managing Partner and Financial Advisor at MPPL Financial, highlights the impact of this strategy: “Since these gifts can be made […]

Why Inherited IRAs Deserve Your Attention

Many people don’t realize how much the landscape shifted with the SECURE Act of 2019 — and more recently, with follow-on regulatory guidance — for those who inherit IRAs. The changes have major consequences for estate planning, tax strategy, and how beneficiaries should approach distributions. The SECURE Act’s Blow to the “Stretch IRA” Before 2020, […]

The Team of Experts Business Owners Need Before Selling a Business

For many business owners, the sale of their company is the largest financial transaction of their lives, and critical to one’s preservation and creation of wealth. If you’re a business owner contemplating a sale of your firm or transfer to children in the next three to five years, then it’s important to thoughtfully assemble a […]

How a Financial Plan Puts You in Control During Times of Turbulence

As we all know, when life doesn’t go as planned, it can create a tremendous amount of financial stress. Any unexpected change in personal circumstances such as a job loss, divorce, or illness can disrupt your sense of security. For some, extended periods of volatility in the financial markets can also contribute to financial stress. […]

Four Ways To Start Planning a Dream Retirement with Your Partner

It’s only natural for a pending retirement to bring a mix of emotions, whether it’s excitement, anticipation, worry, fear, or anxiety. What’s more, if you’re trying to envision how retirement looks like with a partner, these emotions can easily compound. In our coaching practice at Metamorphosis CCT, we frequently see couples who have vastly different […]

How To Save and Pay for College: A Q&A with a Financial Expert

Paying for college is one of the biggest financial challenges families face today. We sat down with Ben Laska, a CFP® professional and MPPL Financial’s in-house expert on college planning, to unpack key strategies parents and prospective students should consider when preparing for this major investment. From saving strategies to tax credits, here’s what you […]

Opening a Roth IRA for Your Minor Child: What You Need To Know

It may seem premature to think about retirement for kids, though it’s a topic MPPL Financial does discuss with some regularity with clients, particularly when 529 planning is also a consideration. Ben Laska, a CFP® professional and MPPL Financial Advisor in our Wausau, WI office shares: “Funding a Roth IRA for minors can be an […]