There’s one silver lining to inflation: Changes made by the IRS to a number of rules could help put more money in your pocket as a taxpayer.

The changes include raising the thresholds for income tax brackets for 2023, as well as increasing the standard deduction. While the IRS makes adjustments to tax brackets annually, the 2023 changes are larger than typical increases, with the income thresholds increasing by roughly 7%. These IRS-adjusted tax brackets will apply automatically when you do your taxes for the 2023 calendar year, so no action is necessary on your part.

There are also increases in the estate tax exclusion and gift tax exclusion. For those seeking to minimize future estate taxes, reach out to your financial advisor or tax professional to further understand the impact of these changes on your unique situation.

When it comes to retirement savings, the IRS once again increased contribution limits for 401(k) plans and IRAs, which allow savers to put away more pretax dollars for retirement. For those not yet retired and working, reach out to your MPPL financial advisor to review these changes and ensure you are maximizing your potential contributions for your unique situation.

Here’s a rundown of key changes made by the IRS for 2023.

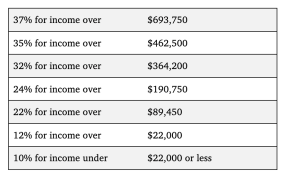

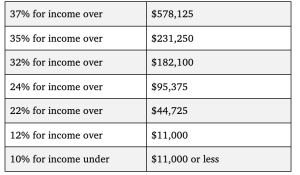

Federal Tax Brackets: 2023

Tax brackets (married filing jointly)

Tax brackets (single filers)

Changes to the standard deduction for 2023

- The standard deduction for married couples filing jointly will increase by $1,800, to $27,700 for 2023.

- For single individuals, the standard deduction will increase by $900, to $13,850.

Federal Estate and gift tax exclusions for 2023

- The federal estate tax exclusion amount for decedents who die during 2023 will rise to $12,920,000. This is an increase of $860,000 over the 2022 level. Please note, some states levy an estate tax in addition to federal estate taxes. The exclusion amount and taxes levied vary by each state so be sure to review your personal situation carefully with a financial and tax advisor.

- The annual gift tax exclusionamount is $17,000 for 2023. This is a $1,000 increase over the 2022 limit.

Changes to retirement contributions for 2023

- Participants in 401(k), 403(b), and most 457 plans will be able to contribute up to $22,500 in 2023, up from $20,500.

- The catch-up contribution for individuals over 50 increases to $7,500, up from $6,500 this year.

- The limit on annual IRA contributions will increase to $6,500, up from $6,000, while the IRA catch-up contribution for individuals over 50 will remain at $1,000.

Closing Thoughts

While the changes described above are the ones that affect most people, there could be other changes that are relevant to your unique situation. As you think about 2023 planning, we encourage you to reach out to your MPPL financial advisor or tax advisor to ensure you are maximizing your tax savings in light of your personal situation.

MPPL Financial has offices in Duluth, MN, Grand Rapids, MN, Wausau, WI and Crystal Lake, IL. While we are based in the Midwest, we work with clients across the U.S.

Investment Advisory Services offered through Midwest Professional Planners, Ltd. (“MPPL”), 2610 Stewart Ave., Ste. 100, Wausau, WI 54401, 1-800-236-6775, an SEC-registered investment advisor. Certain representatives of MPPL are also registered representatives of, and offer securities products involving commission or transaction-based fees through APW Capital, Inc., 100 Enterprise Drive, Suite 504, Rockaway, NJ 07866, 1-800-637-3211. Member FINRA/SIPC/MSRB. MPPL is independent of APW Capital, Inc. Registration with the SEC or State Regulatory Authority does not imply a certain level of skill or expertise.