One of the biggest financial disruptions for some in mid life is divorce. MPPL Financial’s Terri Rau, a Certified Divorce Financial Analyst®, provides insights on the challenges couples face going through divorce later in life and ways to achieve the best possible financial outcomes during this highly emotional time.

What recent trends are you seeing related to divorce?

The statistics may surprise you. Divorce among middle-aged and older Americans is rising. A 2021 study by Bowling Green Family Institute reveals that since 1990, divorce rates have doubled for Americans over 55 and tripled for those over 65, which we refer to as grey divorce.[1]

Grey divorces can be extremely difficult to navigate. Although the children are likely grown, it can be challenging for one or both members of the couple to re-establish their financial lives as they transition into retirement.

One surprising statistic is that seven out of 10 divorces are initiated by the wife.[2] What’s more, the second time around isn’t always a charm. More than half of second marriages end in divorce.[3]

What are the biggest financial challenges you see with couples in the midst of a divorce?

Understanding the differences between the various assets a marriage accumulates and how to separate them as equitably as possible is, without a doubt, the biggest financial challenge in a divorce.

Marital assets can include pensions, stock options, and other employer-provided benefits. Depending on the age of the couple and their family structure, college funding and health care costs may come into play when trying to determine an equitable financial settlement during a divorce.

The complexities associated with these types of assets often lead one or both spouses to turn to a Certified Divorce Financial Analystâ (CDFA) for assistance. A CDFA has the knowledge of tax law, asset distribution, and short- and long-term financial planning to help couples and their attorneys achieve equitable divorce settlements. However, a CDFA is not an attorney. Attorneys are still needed to provide their legal expertise and framework around a divorce.

What type of training is required to become a CDFA?

CDFAs are required to have several years of relevant experience and pass an exam designed by the Institute for Divorce Financial Analysts (IDFA) to receive the designation.

After my own divorce many years ago, I was left with some unintended financial consequences because decisions were made without the proper financial knowledge. I’m passionate about helping others through their divorce process so that they achieve the best financial outcome possible. I always tell people that engaging with a CDFA is a worthwhile investment that can often lower the cost of going through a divorce.

Could you offer some examples of situations when one should seriously consider engaging with a CDFA?

There are three that stand out.

The most obvious is financial complexity. For example, if one person owns a business, the question becomes “How do you value the business and achieve an equitable settlement?” Employee stock options have their own idiosyncrasies that a financial professional needs to evaluate. Retirement accounts, which may appear simple, are also complex to separate: there are different types, each with its own rules that govern withdrawals. An active company 401k is different from a rollover IRA. Then there are Roth IRAs, traditional retirement accounts, inherited IRAs, and pensions. As you can see, once someone starts to unwind all of this, becoming tax efficient and also equitable is a challenge.

A second situation that would warrant engaging with a CDFA is when someone lacks experience with investments, budgeting, saving, or planning for financial goals. A CDFA can assist with all of this before, during, and after a divorce.

The third and often overlooked reason for engaging with a CDFA is when the couple is amicable. In these situations, they can work together with a CDFA to achieve substantial financial benefits for both members of the couple. The CDFA will not only help with valuing the assets, but also create a Marital Settlement Agreement they can give to an attorney, who will finalize the divorce.

What are the primary benefits of guidance from a CDFA?

Gaining certainty about what your financial future will look like, not just on day one, but five, 10, and 15+ years down the road, is a huge benefit. A CDFA can provide a budget going forward if a spouse has not done this before, along with comprehensive financial planning to help the newly divorced manage their money, determine how much to save, and thoughtfully evaluate the best financial moves to make post divorce.

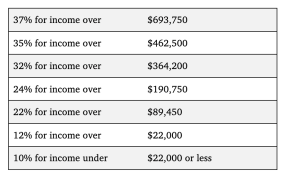

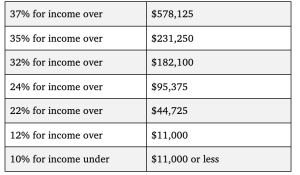

Providing an after-tax equitable settlement is as important as gaining financial certainty. This is particularly important when the couple has a mix of assets, each with various tax ramifications. A CDFA can show a complete before-and-after financial picture that takes each person’s post-divorce tax bracket into consideration, which can impact the face value of certain assets.

Using a CDFA can reduce the total cost of a divorce. For starters, attorney fees will be lower when someone is financially organized and prepared. Prepared clients will ask the right financial questions to minimize overall back-and-forth with the attorney. What’s more, when the CDFA works with both parties, the cost savings can be greater, and more assets may become available for the couple to divide among themselves.

What’s the best time during the divorce process to consult a CDFA?

As soon as divorce is being considered, and even before an attorney is retained. A CDFA can help prepare someone for what to expect throughout the divorce process and provide options on various paths to move forward.

How does a CDFA typically work with a divorce attorney?

The CDFA’s work complements the work performed by an attorney. Attorneys aren’t financial experts, and CDFAs aren’t legal experts. They can work as a team to bring clarity to the lifelong decisions being made during a very emotionally stressful time and help the divorcing person achieve the best possible long-term outcomes.

Terri, thank you for your insights on this timely and sensitive topic.

Additional resources

Common Money Mistakes to Avoid in Divorce

Divorce Financial Planning Services

MPPL Financial has offices in Wausau, WI, Duluth and Grand Rapids, MN, and Crystal Lake, IL. While we’re based in the Midwest, we work with clients across the entire U.S.

Investment Advisory Services offered through Midwest Professional Planners, Ltd. (“MPPL”), 2610 Stewart Ave., Ste. 100, Wausau, WI 54401, 1-800-236-6775, an SEC-registered investment advisor. Certain representatives of MPPL are also registered representatives of, and offer securities products involving commission or transaction-based fees through APW Capital, Inc., 100 Enterprise Drive, Suite 504, Rockaway, NJ 07866, 1-800-637-3211. Member FINRA/SIPC/MSRB. MPPL is independent of APW Capital, Inc. Registration with the SEC or State Regulatory Authority does not imply a certain level of skill or expertise.

[1] https://www.bgsu.edu/ncfmr.html

[2] https://www.asanet.org/women-more-likely-men-initiate-divorces-not-non-marital-breakups/

[3] Psychology Today, The High Failure Rate of Second and Third Marriages